Accounts offered at Exness platform

Exness is a financial intermediary for CFDs, an online broker recognized worldwide. Range of assets focused on the foreign exchange market (Forex). Although it also allows trading, through CFDs, on other instruments that we will see in this article.

The company was created in 2011 and currently provides its services with very competitive conditions. Exness allows flexible leverage (offers a specific level of leverage depending on the knowledge and experience of the trader) and variable spreads that can be as low as 0.1 pips depending on the type of account and the conditions of the market to trade. But we will get to this point.

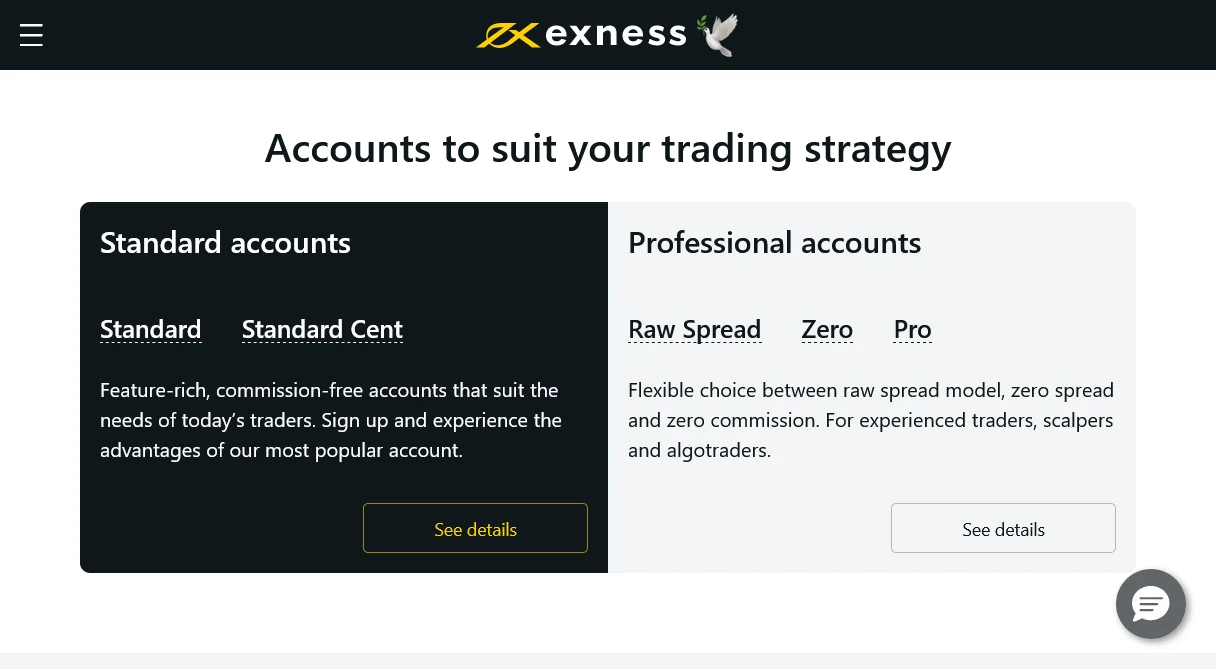

Exness is characterized by not having its trading desk. In other words, it is a No Dealing Desk (NDD) broker. The trading accounts it offers its clients segmented into two groups:

- Standard Accounts;

- ECN accounts.

These two types of accounts will be seen in more detail when we get to the corresponding section. For now, it suffices to say that neither Exness acts as a counterparty to the client’s transactions. This is a guarantee of extra reliability against other Market Maker brokers (who do act as counterparty to trades), and this avoids potential conflicts of interest that may arise with their clients.

Trading accounts

At the beginning of this text, the two main segments of trading accounts of the Exness broker mentioned.

A priori, the difference between the two is that while one uses instant exchange servers (the Standard accounts). This means that execution is performed immediately against other participants. While in ECN accounts orders are placed directly on the market. In no case does Exness act as a counterparty for the user. However, it guarantees liquidity and instantaneous order execution.

ECN is the automated trading network that connects brokers with their liquidity providers (such as banks, other brokers, Market Makers, etc.). Having access to the most favourable price offered and transmitting to the trader these best conditions. For this reason, the spreads are usually variable when we work with a broker without a trading desk (not Market Maker).

Exness does not allow for scalping on standard accounts; in this, it is similar to a Market Maker. You must open an ECN account if you want to perform this style of trading.

Let’s take a look at the account types offered by Exness, starting with the Standard accounts:

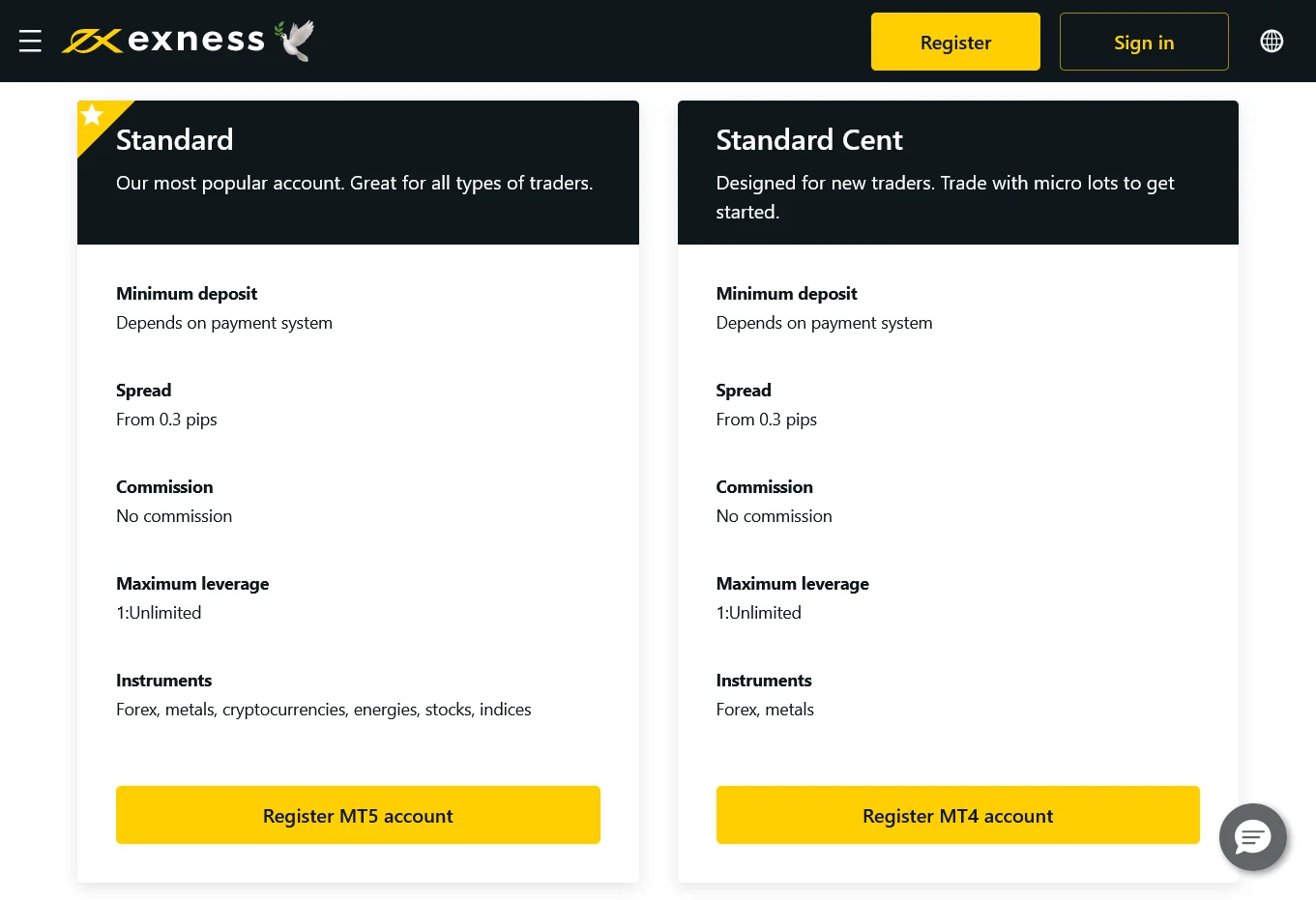

Cents account

It is the only account where the minimum deposit is only 10 euros. Although it also allows you to work with dollars and pounds.

It guarantees instantaneous execution of trades, allows a maximum of 300 orders at the same time and only allows a total of 27 assets to be traded (25 currency pairs and two metals).

The minimum spread it charges is 1.5 pips, which can be increased depending on market conditions. It is possible to open micro-lots (0.01).

Standard Account

For this type of account, we require a minimum deposit of 100 euros, dollars or pounds.

It allows you to have a maximum of 100 orders open at one time, open micro-lots and offers a maximum of 76 instruments to trade (57 currency pairs, five metals and 14 stocks). The charged spread is a minimum of 1.3 pips.

Stock Account

It has the same conditions as the Standard Account, only, in this case, the minimum spread is 0.1 pip, and it offers more than 180 CFD shares to trade (funny thing because we have counted a maximum of 176 shares in its listing).

Let’s go now to the ECN accounts.

ECN Zero

The minimum deposit for this account is 200 euros; it also works with dollars and pounds.

There is no limit to the number of operations opened at the same time (this is true for all ECN accounts). It also allows you to open micro-lots and you can trade 47 currency pairs, five metals and 14 stocks.

The spread is a minimum of 0.5 pips per trade.

ECN account

This account requires a minimum opening capital of 500 euros. In addition to the spread, which is a minimum of 0.1 pips, a fee of $2 per lot. This commission applies when opening and closing the deal. In other words, a trade will cost $4 just for opening and closing it.

In our opinion, Exness is relatively transparent in terms of the commissions charged, with the latter being clearly and concisely outlined in your account specifications.

The instruments allowed to trade are 45 currency pairs, three metals and 14 stocks. It will enable you to open micro-lots.

ECN MT5 account

This account has the same conditions as the previous one; the only differences are observed: The spread is 0.2. The assets allowed to trade are 34 currency pairs and two metals.

Otherwise, you have Level II Data. This means that you can see better market depth data.

Exness Pro Account

This trading account is intended for professional traders. This is demonstrated by the minimum capital required to open an account, which amounts to 25,000 euros. They do not charge any commission and the spread can be as low as 0 pips.

It allows trading with 44 currency pairs and two metals and the possibility of opening micro-lots.

DEMO account

To finish this section, we will talk about the Exness demo account. The demo account is an excellent way to try out the broker’s services, and you can also use it to learn how to trade or test your strategies without putting your money at risk from the start.

It comes loaded with a virtual money balance and offers you the same tools as a real account. You can familiarize yourself with all the options and open trades with that virtual money. When you are ready, you can move on to a real money trading account.

The Exness demo account allows you to trade for up to 60 days before it is deactivated. It is also possible to open as many demo accounts as you wish.

Our Advantages

✅ Free Funding

✅ Multiple trading accounts

✅ Insurance for clients’ funds

Zero Spread Account

✅ Raw spreads with 0 markups

✅ Low Commissions

✅ Low Cost Trading

Bonus Offerings

✅ 100% Supercharged Bonuss

✅ 100% Credit Bonus

Become an Affiliate

✅ Earnings up to $15 per lot

✅ Auto or Manual Rebate Systems

✅ Free Marketing Tools

Access Requirements

Opening a trading account with Exness is smooth, on their website, there is a section called “Client Account Opening Agreements” where all the contractual information is transparently displayed for the user to download.

However, let’s summarize the steps required to open an account with Exness:

- Access the corresponding form on the broker’s website, by clicking on the “Registration” tab.

- Fill in the data and wait for a PIN to arrive by SMS.

- Enter the PIN and click on “Enter”.

- Deposit funds (see Deposit and Withdrawal Policy section).

- Send documentation justifying our identity and address (this is common in any regulated broker, it is a measure imposed by the European MiFID directive on financial intermediaries).

The documentation required to justify our identity:

- Identity document (ID card, passport, etc.)

- Proof of address (recent utility bill, such as electricity, gas or landline telephone). But beware, Exness does not accept mobile phone bills)

All the documentation can be managed, and once the account is opened, in our control panel MyExness or send it to the broker by e-mail.

Fast transactions 24/5 during the standard trading hours.

Deposit Fees: Exness does not apply any deposit fees.